Shield Launches Enhanced Version of its Financial Compliance Data Management Platform

The new version features powerful AI capabilities for false positives reduction and Financial Context Recognition

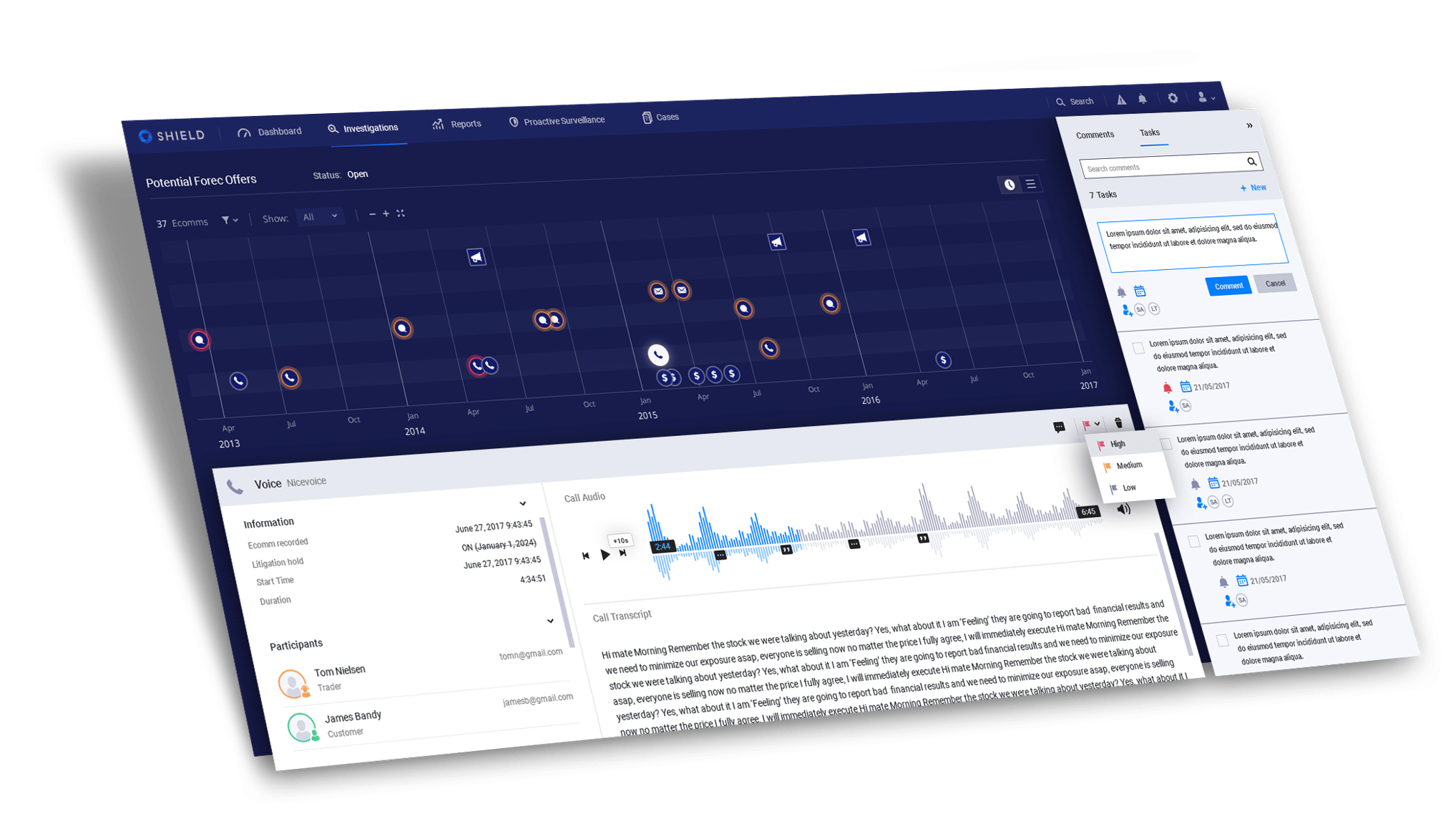

London, Copenhagen, and Tel Aviv – 8th January 2019. Shield Financial Compliance (Shield FC), a cross-regulation compliance platform that provides a 360 view of electronics communications (eComms) and trades to make compliance more efficient and ROI driven, is proud to announce the launch of its latest version. New features include powerful AI for the reduction of false positives and the proprietary technology of Financial Context Recognition (FCR).

Ofir Shabtai, Co-Founder and CTO at Shield FC commented, “The new features address and resolve important issues facing modern financial firms. False positives have become a highly worrying statistic – one Tier-One European Bank we have spoken to even admitted it had reached an incredible 98% false positive rate on their day-to-day work.”

Ofir continued, “Another major challenge is automatically recognizing the context of trade information from vast amounts of recorded eComms (such as email, chat, and voice), so it can be correlated to the relevant trade. Our new functionality is designed to address both these needs in an intelligent and highly usable way.”

Being resource-intensive to investigate and often hindering the smooth investigation of real issues, false positives are a big issue for compliance monitoring systems. The Shield FC platform utilizes a highly specialized AI engine to investigate and evaluate all alerts, accurately eliminating a high percentage of these and saves wasting resources and time of the compliance team.

Shield FC’s platform also employs a new unique proprietary engine developed by the company to accurately and reliably deliver powerful FCR across all eComms – including emails, chats, Fin-chats, and voice recordings. Using NLP (Natural Language Processing) and an AI-based component, the technology delivers levels of accuracy and speed that would be impossible for a human team to achieve.

Ofir added, “FCR is a huge step toward accurate automatic trade reconstruction and finding the right related eComms amongst often seemingly unfathomable amounts of unstructured data. The FCR algorithms will extract any chosen information from conversations, [OS|S1] FCR is trained to understand the context of conversation especially the challenge of understanding the traders’ lingo.

The latest enhancements build upon Shield FC’s already highly powerful, yet cost-effective and easy-to-use data platform. It transforms siloed eComms compliance platforms into a single end-to-end solution to reconstruct, report and interact with complete trade timelines via an intuitive point-and-click user interface. A highly secure out-of-the-box solution, it also provides a wide spectrum of bespoke options to fit the requirements of any financial firm, whilst Shield FC ensures it evolves to meet all future needs.

The Shield FC platform is also a finalist in both the ‘Best Trade Reconstruction Solution for Best Execution’ and special ‘BSO Award for Fintech Innovation’ categories of the TradingTech Awards Europe 2019

Related Articles

Shield Reacts: The Midas touch

Subscribe to Shield’s Newsletter

Capture everything. Deploy anywhere. Store in one place.