The Dual Face of AML: When Challengers Move Too Fast, and Incumbents Move Too Slow

The financial services industry is evolving at a pace like never seen before. Newcomers saw the opportunities of the digital age and incumbents realized they needed to act fast. Many say the rise of fintech was a direct result of the loss of trust and reputation toward banks after the financial crisis in 2008.

Now, more than 10 years later, the market has changed. Financial services have changed.

One thing hasn’t changed: the financial services industry seems to be getting in a new crisis of trust. The industry is suffering from a lack of good governance. Bankers are afraid to read newspapers because most bank-related news today is yet another accusation of fraud.

Banks push for, and consumers often ask for digital services. Digital services are what they got. That is: banks and consumers got digital services in the front, but they didn’t get to the end-to-end process yet.

Money flows much faster than it used to do and the pressure on financial results is driving banks to more automation to reduce costs.

Interestingly enough, banks are also fighting for the most seamless onboarding experience. Consumers not having to pass by the branch for onboarding is very attractive for both digital consumers as it is for banks, but it creates also new risks with regards to identification and all related consequences for Know Your Customer (KYC) processes.

Incumbents Move Too Slow in the Digital Age

Incumbents seem to suffer from a lack of digitization. Although it looks very digital in the front end, the back end may not always be aligned with these newly digitized inflows of data: onboarding clients is easy, but making sure their data remains in line with reality is often another story.

That is a serious problem.

Just to name a few penalties for European banks related to AML:

- Société Générale paid $1.4 billion to US Federal and State Authorities

- BNP Paribas paid €10 million to the French bank watchdog ACPR, 4 years after the 9$ billion settlement with US prosecutors in 2014

- ING Group paid the Dutch regulator €775 million to the Dutch prosecutor

The biggest lawsuit is not even on this list, because the investigations are still ongoing. Danske Bank is told to have laundered €200 billion through its Estonian branch.

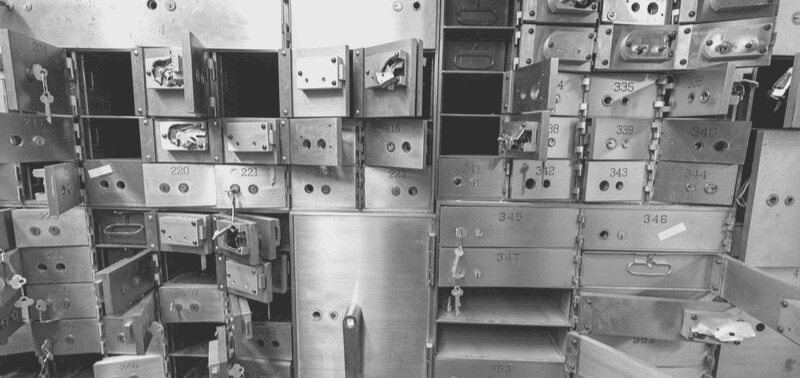

Customer onboarding in the digital age is one thing. Remediation is another one: did banks take sufficient measures to keep their customer’s data in line with reality? ABN AMRO Bank, for example, is currently checking ALL its retail customers to make sure their data are in line with the actual reality, and bullet-proof when it comes to AML controls.

It doesn’t matter whether the issue is a human or a machine error. It needs to be resolved. Good control mechanisms, top-notch technology, and a solid team for human intervention must make sure all incumbents get aligned with today’s digital reality.

Money flows much faster than it used to do and the pressure on financial results is driving banks to more automation to reduce costs.

Challengers Move Too Fast in the Digital Age

On the other side of the spectrum there are the newcomers, the challenger banks that seem to be going too fast, which is not necessarily a good evolution either, N26 was accused of not spending enough resources on the transaction screening, and getting the KYC process waterproof.

Revolut hit the press almost a year earlier when a leak was found in the AML checks resulting in thousands of suspicious executed transactions that should have been stopped. They didn’t have the right measures in place to make sure their automated processes were doing what they were supposed to be doing.

The main challenge for the challengers was their growth: they were unable to find enough qualified people to close the process.

Given the attention that Revolut has put on compliance the last year also seems to indicate that they didn’t put enough priority on the department when they scaled up in the first place.

Regtech to the rescue, under supervision of the human eye

Although the court files often date back years ago, the reputation of the industry is still suffering today. AML must be taken seriously.

This also explains why there is so much noise around regtech. For a long time, this was perceived as just a new buzzword, because pitching the company as being a fintech or active in blockchain didn’t work anymore to get attention.

Today we see this is not a hype, but a reality that will remain important for many years to come. Companies in regtech have one driver in their business: making sure their systems work, without any uncertainties. This is their sole revenue generator and therefore they are often better placed than banks in making sure they have the latest technologies.

Compliance is just a cost center for a bank, that requires more attention than a bank would like to give it.

Regtech companies understand the importance of a solid data infrastructure, they know the value of AI and even blockchain in the KYC process, and last but not least: they know how to balance human and machine for compliance governance that is ready for AML in 2020 and beyond.

Conclusion

I believe that as long as banks keep suffering from this kind of infringement there remains to be a bright future for regtech.

The rise of instant payments, open banking, and connected devices will make it only more important to be capable of providing a real-time and correct interpretation of data to avoid this kind of problem, for both incumbents as well as for challengers.

Related Articles

Shield Reacts: The Midas touch

Subscribe to Shield’s Newsletter

Capture everything. Deploy anywhere. Store in one place.