FCA reports a decline in suspicious transactions and order reports (STORs)

Publication of the FCA’s annual incidence of market abuse as recorded for the year 2019 raised a few eyebrows when the data was made available on 28 February 2020. Insider trading is one of the numerous forms of market abuse monitored. Other forms include spoofing, layering, wash trading and more. For the first time since 2016, the number of insider trades declined. Let’s discuss some possible reasons for this decline.

What the data tells us

The Financial Conduct Authority (FCA) protects consumers as the conduct regulator for over 59,000 financial firms in the UK. Their mandate is to ensure that consumers get a fair deal and they do this by policing the financial markets to ensure honesty, fairness, and effectiveness of those markets. To this end, they track all suspicious transactions and order reports (STORs), classifying them as “insider trades,” “market manipulation” or “other” forms of market abuse.

Each year, the FCA receives tens of thousands of calls and emails from consumers and firms alerting them to possible examples of harm or misconduct. The FCA holds the legal authority to enforce its regulations. They can such measures including imposing bans or fines as well as prosecution at the individual and firm-level.

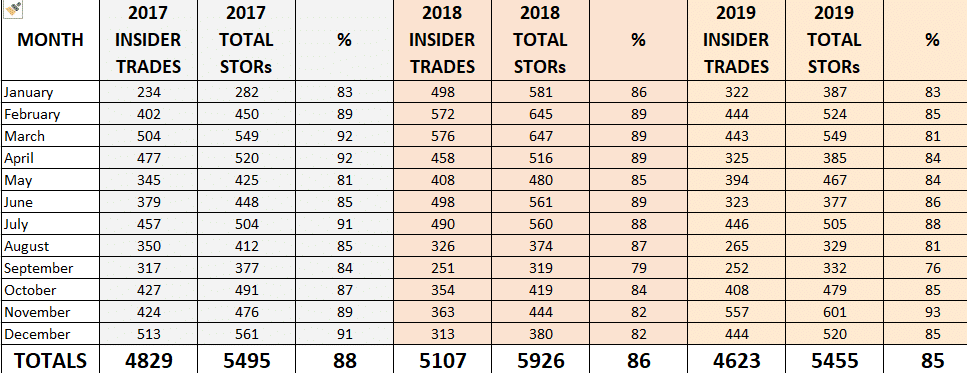

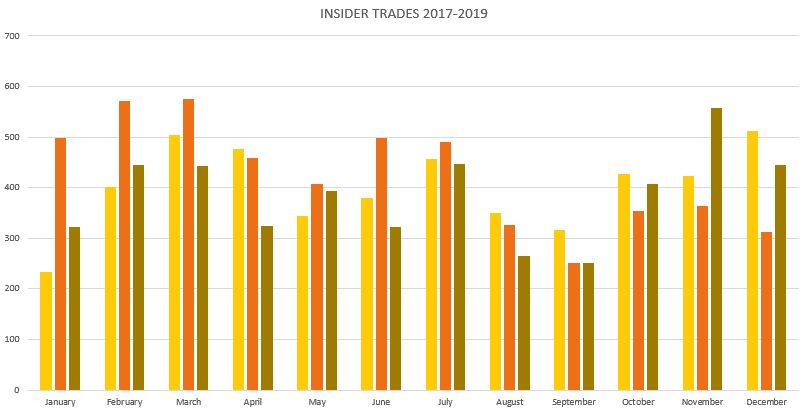

The 2019 data looks similar to the 2017 data (see Table 1 and Figure 1; data source Financial Conduct Authority). In 2017, in terms of total STORs recorded, there were 5495, compared to 5926 in 2018 and 5455 in 2019. Comparing the percentage of insider trades as a portion of the total STORs identified, the numbers for all three years for which the data is available are highly similar but decreased slightly y/y: 88% in 2017; 86% in 2018 and 85% in 2019. The low/high numbers for the percentage of insider trades versus other forms of market abuse was highly variable y/y with 2019 showing the greatest difference: the percentage of market trades ranged from 83-92% in 2017; 82-89% in 2018; and 76-93% in 2019.

Possible reasons for the decline

Overall, the advances in surveillance technology, including the ability to monitor e-Comms have improved considerably since 2016 when these suspicious transactions and order reports came under the formal scrutiny of the FCA. FINRA, authorized by US Congress, has advanced AI and machine-learning capabilities which are applied to scrutinize billions of daily market events. They have oversight of more than 634,000 brokers.

Given the growth of the compliance technology market as represented by the number of fintech providers, it appears that financial firms are increasingly adding detection capabilities. Even small to midsize firms now have affordable solutions to monitor, detect and report market abuse of all forms, including those enabled by e-Comms. And those firms that already have surveillance systems in place are making them more robust. The enhanced prevalence of these solutions also makes it easier for consumers to report market observations. Hence, the combination of banks and consumers both being more proactive is likely driving the decline.

In December 2018, the FCA published Chapter 8 addition to its Financial Crime Guide detailing augmented supervisory efforts. The expanded guidelines explicitly outlined how firms were obligated to counter the risks of insider dealing and market manipulation, both of which were criminal offenses. Some firms have since begun to assess the suitability of clients, flagging those with higher risk and restricting market access when appropriate to do so. With more firms being more vigilant in 2019 than they presumably were in 2018, the number of insider trades declined.

What’s next?

Although the number of insider trades declined in 2019, the number of market observations continues to grow y/y. The FCA has highlighted how firms, in their efforts to demonstrate compliance, are often reporting incidents of harm which the FCA does not necessarily regard as a STOR and hence, does not classify it as such. In 2019, the FCA released guidance on market observations to aid in their classification. The quality of these market abuse monitoring solutions has continued to improve. As a result, incidents of market abuse or harm can now be more precisely tracked and categorized. This may explain the spike in market abuse observed in 2018 but the subsequent decline observed in 2019.

Market abuse monitoring solution providers have the technology and expertise to ensure compliance with federal market regulations. The annual costs of these solutions are becoming more affordable as more vendors bring their detection solutions to market. There is no longer the question if a firm, large or small, should be enabled with a sophisticated solution for monitoring market abuse; the question now is how robust is the solution that you’re using and can it effectively monitor all events, including those on emerging eComms platforms?

Related Articles

Shield Reacts: The Midas touch

Subscribe to Shield’s Newsletter

Capture everything. Deploy anywhere. Store in one place.