Embracing the potential of RegTech

This article was originally posted in The Financial Technologist Magazine when Shield was recognized as one of the Ultimate Fintech Workplaces of 2019

When Shield launched in 2018, we had a very clear vision of what the RegTech industry needed.

It seemed obvious to us that a successful RegTech startup needs to look toward future needs, closely studying the regulations and the challenges this poses, anticipating what the market requires, and ensuring the right solution is in place when it is needed. We observed that many of our peers and competitors seemed to lack this vision and found ourselves surrounded by bigger,

more established vendors who kept addressing the challenges with the same linear approach.

Shield was an ’outsider’ trying to do things differently (the right way in our view) – a tough ask in a very traditional RegTech industry. Building a business

Whilst we knew our approach was right, launching a new venture into what was already an increasingly crowded market brought with it many challenges – funding, getting the right mix of technical and business expertise, as well as building a team that shared the same aspirations, ambitions, and outlook.

There are many external pressures on a fledgling business, so it’s essential the team is closely knit and able to work together to overcome challenges as they inevitably arise. Shield has an ongoing drive to onboard the best talent and continues building and evolving our winning team. Early in the process, we learned a very important lesson – whilst having ambitious goals is essential for success, you also need to appreciate that you are unlikely to have the finances or human resources to do everything you want to do straight away. This can be frustrating, but it’s vital not to spread resources too thinly and potentially risk your core projects.

Challenging Perceptions

Another big challenge is that some potential financial institutions can have a highly conservative mindset when it comes to their business requirements and technology vendors. Even when you know you have the right approach and you are supplying the best-in-class solutions; you still need to persuade the market to make what they consider a calculated leap of faith.

Undoubtedly persistence and determination are key virtue for a successful business and one which Shield has appreciated ever since our launch. Perception is undoubtedly an important

the factor for any business and it can be even more of a challenge for smaller firms to gain recognition and build a solid reputation that can compete with the bigger players.

Offering Something New and Better

Change is often good and even the ‘conservative’ financial industry stands to benefit hugely from investing in new and innovative vendors, who have a far greater incentive and ability to offer more than many established suppliers. Although it is sometimes seen as a cliché, all industries have their maverick players, the new company that tears up the rule book and finds a better way

of doing things. With rapidly evolving regulations and legislation designed to meet the ever-faster pace of technology changes, there has never been a greater need for financial businesses

to invest in the right RegTech solutions, to protect them from falling foal of the regulators (and the consequent financial and reputational penalties involved)

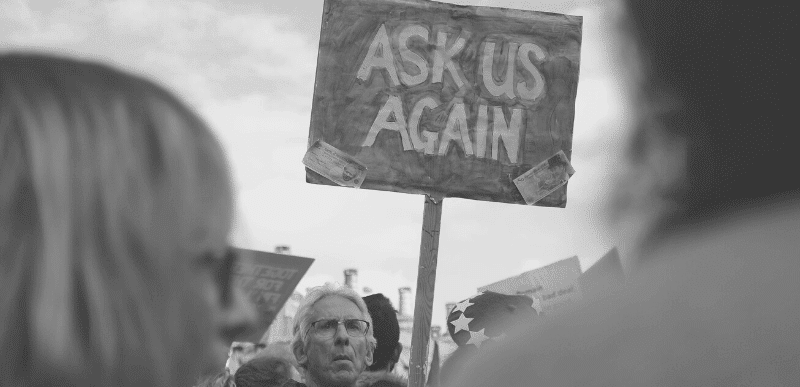

The other ‘elephant in the room’ is, of course, Brexit

Challenges for the Industry

These are interesting times for the global financial sector, but as a business, we thrive on these challenges!

The recent tightening of legislation (such as GDPR and MiFID II) and forthcoming EU ePrivacy regulation (for example) are making it more important than ever that financial firms control,

record and fully understand their data, obligations, and needs. However, traditional manual-driven risk and compliance management is expensive and highly inefficient. Currently, 20% of operational costs (along with10-15% of employees) in the financial services industry are attributed to risk and compliance management yet fines and reputational risks are still on the rise – with these costs expected to double by next year. Clearly, this is unsustainable. Firms must reduce these costs by employing the right solutions, breaking down silos and ensuring the process is viewed as a benefit rather than a grudge cost. Realistically, financial firms need a holistic approach to risk and compliance management that encompasses both compliance and business intelligence and

includes the whole organization. Data must be captured once for all requirements, reducing costs and customer frustration – so intelligent automation is the only viable approach. The other ‘elephant in the room’ is, of course, Brexit and the uncertainty over how regulations will lie once the process has been agreed upon and completed. This is heightened even further by the potential of a no-deal Brexit, which would not only directly affect UK firms looking to trade internationally (especially with the EU) but also any international traders looking to trade with the UK.

Uncertainty is always the worst-case scenario for the financial industry and RegTech solutions will be invaluable in helping firms navigate the complicated and potentially dangerous post-Brexit

regulatory landscape.

Looking Ahead

We believe the rise in the use of electronic communications (eComms such as email, SMS and WhatsApp) is set to continue unabated, not only for customer communications but also in internal communications. This means firms need to keep an even closer eye on their communications channels to ensure they meet tightening legislation. With this increased complexity there will undoubtedly be a big increase in artificial intelligence-driven predictive compliance. Naturally, being able to predict potential issues and solve them before they can become a problem is a huge advantage for any financial firm. Many financial firms will also need to re-evaluate their data quality and integrity, breaking any data silos within the organization to ensure they are fit to meet

the latest data legislation and the upcoming EU ePrivacy legislation, to avoid potential financial and reputational damage. Whatever the political decisions from Brexit, the financial industry in the UK, the EU, and Internationally will need to untangle the legislative challenges and find ways to work together moving forward. On the legislation front, we have already started to see the first notable GDPR fines and now the industry has seen the regulator flex its muscles, it will undoubtedly shape the way the financial industry as a whole deal with regulatory compliance and how it will engage with technology to do this.

In uncertain times we all need reassurance and the financial industry will appreciate the true worth of innovative and dependable automated RegTech solutions, which is at the heart of

what Shield provides.

Related Articles

Shield Reacts: The Midas touch

Subscribe to Shield’s Newsletter

Capture everything. Deploy anywhere. Store in one place.