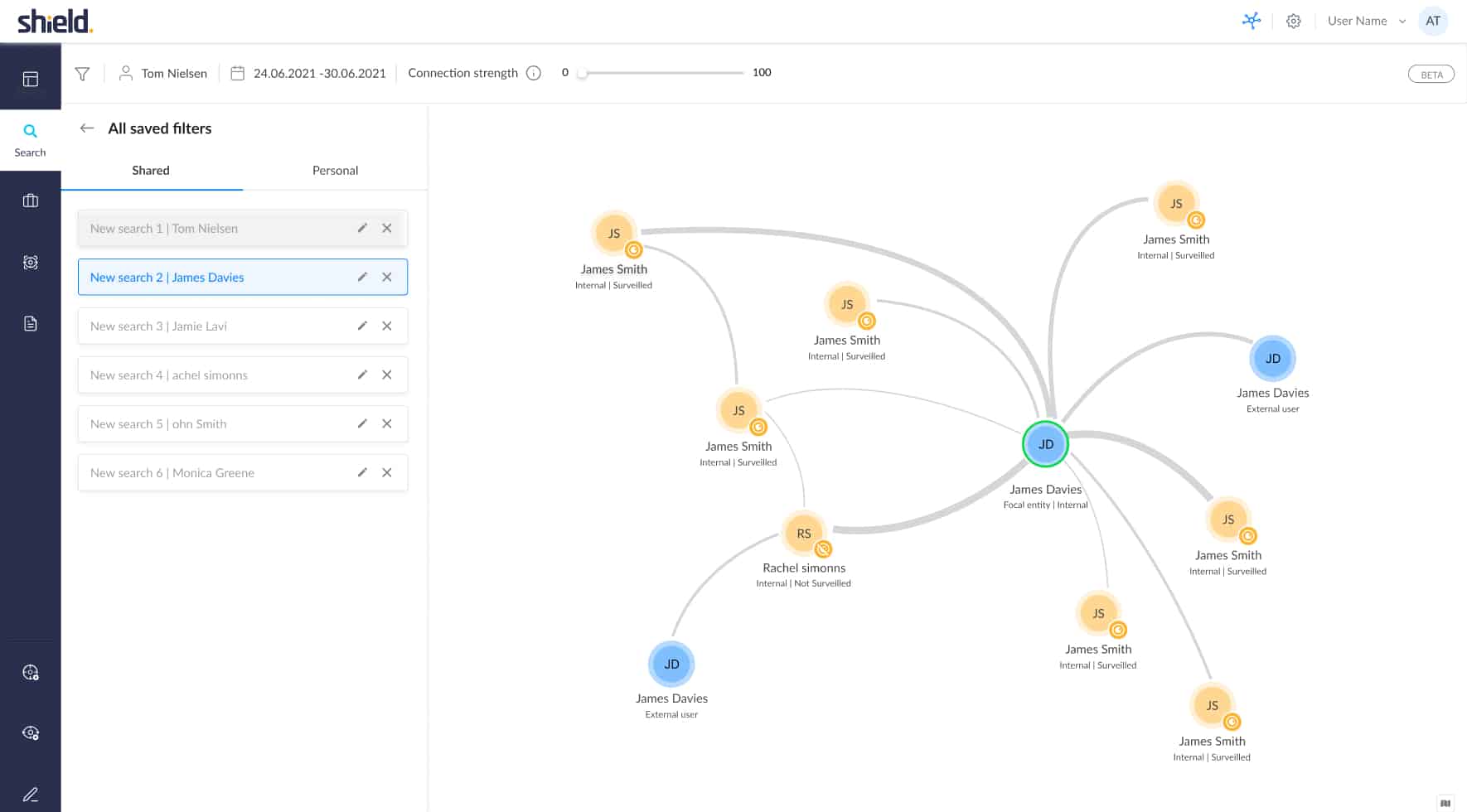

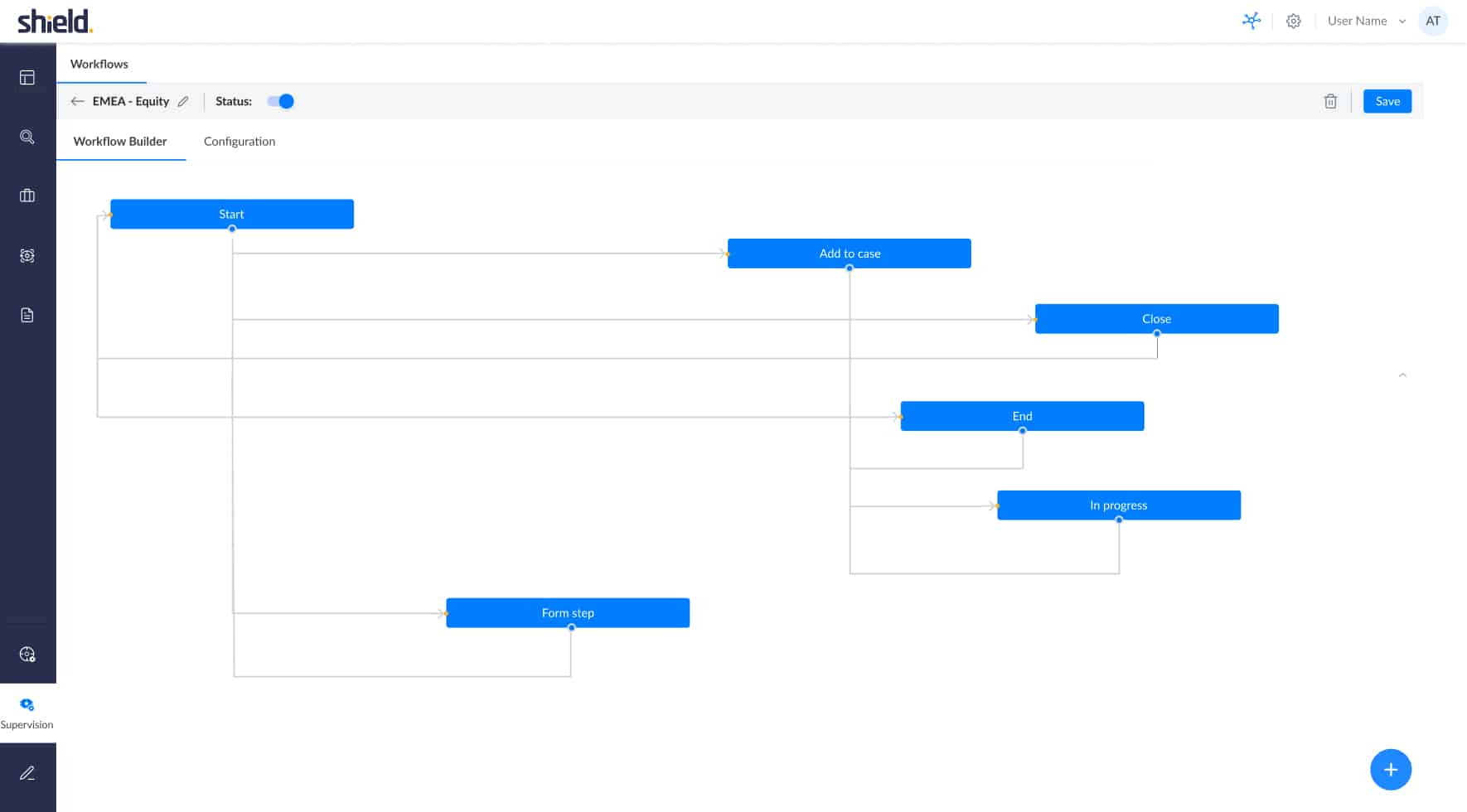

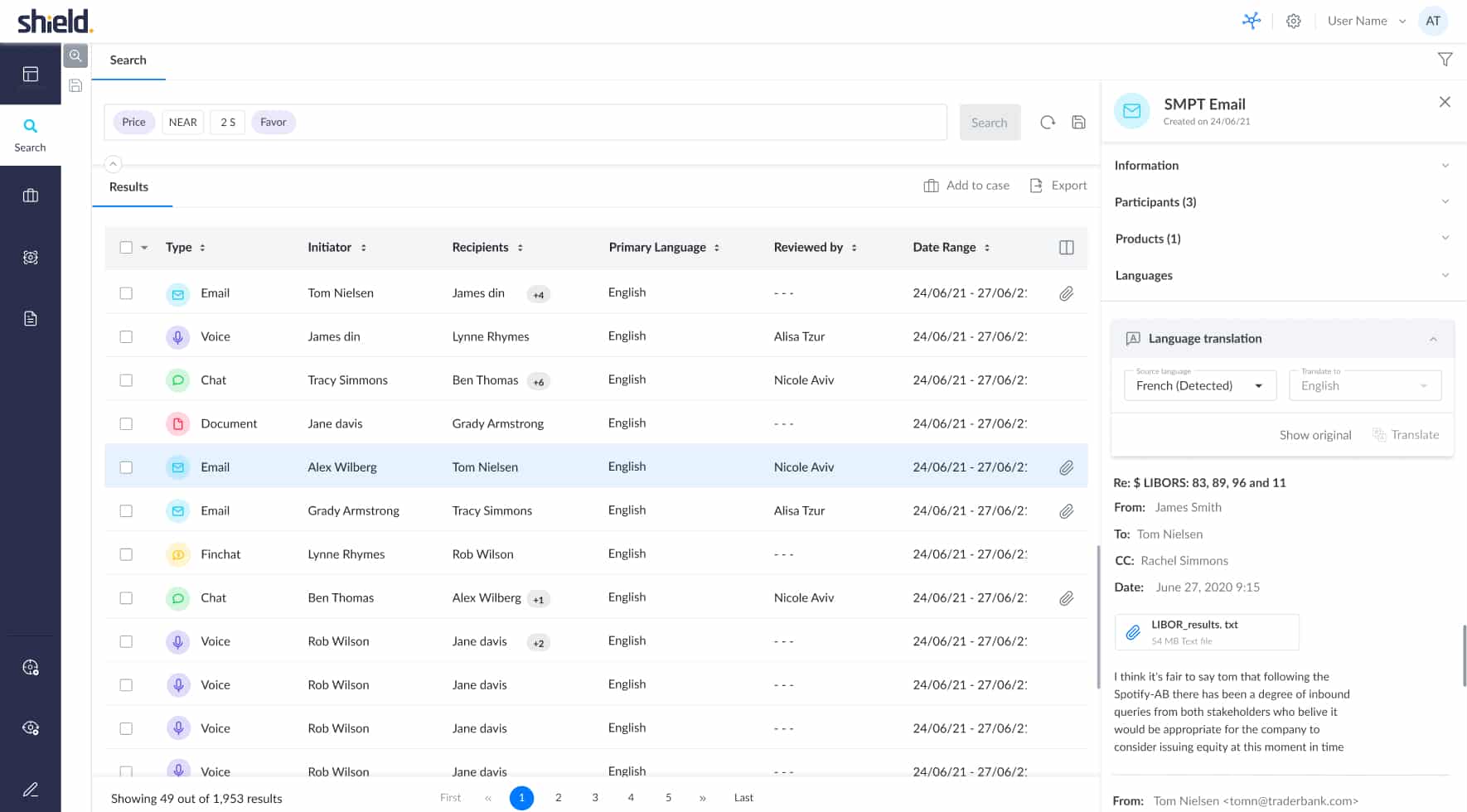

Digital Communications Compliance Platform: A Buyer’s Guide

Explore the dynamic landscape of communications monitoring in our latest buyers’ guide for surveillance. As surveillance teams face a variety of challenges—escalating alerts, decreasing relevance, and mounting compliance fines, choosing a surveillance solution can feel like one more insurmountable task.

Download report >