Critical insights into communications compliance

Message volumes have increased significantly across decentralized work environments and multiple eComms channels. Making sense of the mass of scattered data can be challenging. This leaves compliance teams buried under an avalanche of electronic communications and blind to risk. Firms need a way to understand context and see what matters most amidst lexicon-generated false positives and flattened content across what is often several platforms so that they can get ahead of risk.

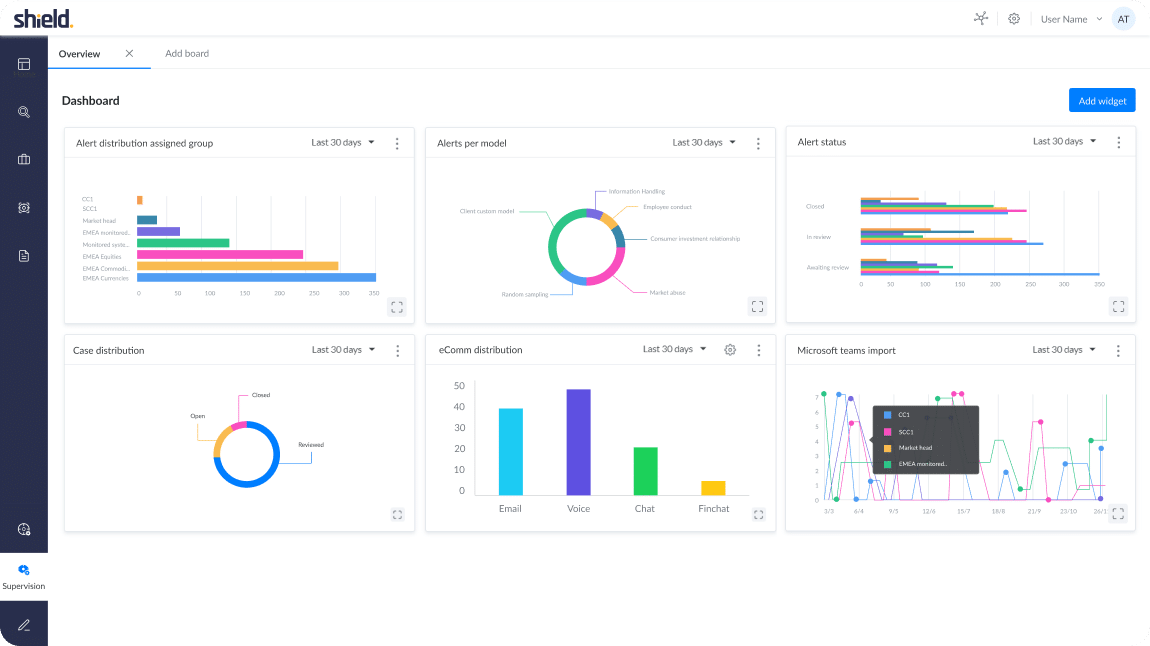

Shield’s end-to-end solution offers a centralized platform purpose-built for the financial sector to evaluate risk across every eComms channel including email, chat, social, text, and voice. Shield uses behavioral analysis, advanced AI methods of semantic detection, and industry expertise to effectively cut through the noise and expand coverage. Transparent models deliver risk insights on every alert, making it easy for compliance to focus on what matters.

Shield empowers compliance, eDiscovery, and Surveillance teams to read between the lines of their employee communications.

Shield’s AI models find relevant signs of risk and intelligently filters alerts through multiple eComm’s channels, providing comprehensive insight to drive down false positives.

Shield’s agile, cloud-first solution provides flexible records management policies, near-instant search results with complex query building, no-cost exports, and custom workflows.

The Shield platform gives data context and integrity in compliant WORM format for risk insights, efficiency, and scalability.

The Shield platform delivers advanced AI-driven data insights across any data source and over 80 languages for surveillance, supervision, eDiscovery, and records management. Paired with the elasticity of Amazon Cloud Services, Shield provides a solution unique within the space that gives comprehensive coverage, meaningful alerts, and flexible records management at scale. With a highly configurable system, organizations can deploy quickly and easily in the Amazon cloud while leveraging existing agreements that may already be in place for web services with Amazon. Shield’s partnership with AWS provides customers with the best use of prior commitments as well as the advantage of ownership and control over their own data.

Shield allows firms to leverage the scalability of AWS hosting so their bucket matches the size and mass of data held by the organization. Additionally, since the firm owns and manages their hosting contract with Amazon, they control their data. This allows companies the option to migrate, export, or make changes as needed, lending elasticity to policies around data management.

Amazon cloud services can be deployed in any region or multiple regions, making Shield the global solution for fast-changing international compliance requirements. Given the SaaS based structure, environments can be spun up quickly and on-demand as needed making Shield a solution that can be flexibly deployed per an organization’s specific needs.

Contact Brian Panicko at [email protected]

or schedule a call with us.